COSO ERM Framework Explained in Simple Terms – What It Is and Why It Matters

Let’s face it—risk is everywhere. From market changes to cyber threats to supply chain delays, businesses are constantly facing uncertainty. But instead of just reacting to problems as they come, what if you had a structured way to plan for risks, make smarter decisions, and drive performance? That’s exactly what the COSO ERM Framework helps you do.

In this article, we’ll break down this framework in easy, everyday language—no MBA required.

What Is COSO ERM?

The COSO ERM Framework is a guide that helps businesses understand and manage risk in a structured, strategic way. “COSO” stands for the Committee of Sponsoring Organizations of the Treadway Commission, a group that develops frameworks for better governance, ethics, and controls.

ERM stands for Enterprise Risk Management, and COSO’s version is one of the most widely used tools for building risk-smart organizations.

In simple terms:

It’s a blueprint for making better decisions by looking at risk not just as something to avoid—but as something that can shape business success.

Why Should You Care?

Every business wants to hit goals, grow, and avoid major disruptions. But risks—big and small—can throw those goals off track.

Here’s why the COSO ERM Framework is worth your time:

- It makes risk part of everyday decision-making

- It helps connect risk with strategy and performance

- It builds a culture of transparency and responsibility

- It supports smart responses, not just fast reactions

Whether you run a startup or work in a large corporation, COSO ERM helps you plan better, act faster, and grow stronger.

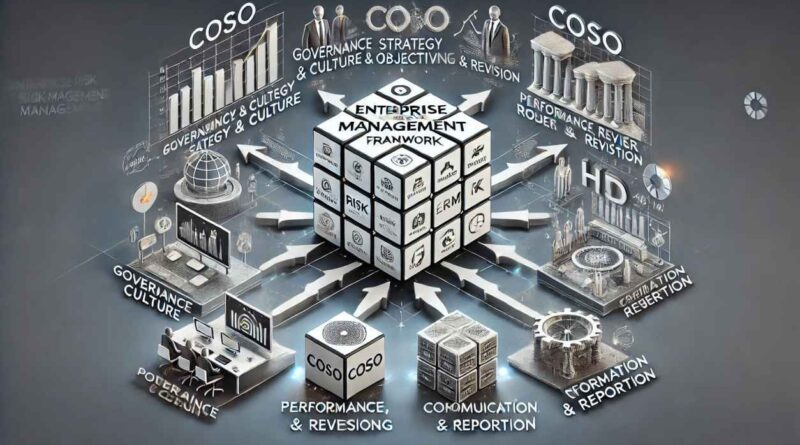

The 5 Main Pieces of the COSO ERM Framework

The COSO ERM model is made up of five parts, all of which work together. Think of them like puzzle pieces that form a complete picture of good risk management.

1. Governance and Culture

This is your foundation. It’s about how your leadership sets the tone for how risk is viewed and handled.

- Do leaders talk openly about risks?

- Are ethical values clear?

- Does everyone understand their role in managing risk?

When governance is strong and the culture supports honesty, risk can be tackled without fear or finger-pointing.

2. Strategy and Objective-Setting

You can’t manage risk if you don’t know where you’re going. This part connects your organization’s goals and strategy with the types of risks you’re willing to accept.

- What’s our mission and vision?

- What’s our “risk appetite”?

- Are our goals realistic, or are we pushing too far?

Good strategy considers both opportunity and danger.

3. Performance

Now you’re putting things into action. This step helps you figure out:

- What risks might impact our goals?

- How likely are those risks?

- What can we do about them?

It’s about choosing the right response—maybe reduce the risk, avoid it, share it (like insurance), or accept it.

4. Review and Revision

The world changes. Plans change. So your approach to risk must evolve too. This part is about reviewing what’s working, what’s not, and what needs to be updated.

- Did we miss anything?

- Did something unexpected happen?

- Should we tweak our strategy or goals?

Reviewing regularly helps avoid repeating mistakes.

5. Information, Communication, and Reporting

No one can manage risk in the dark. Everyone in the organization needs timely, clear, and accurate information about what’s going on.

- Are we sharing risk updates across teams?

- Do we have systems for reporting issues?

- Are leaders aware of what risks are heating up?

When communication flows well, small problems don’t turn into big ones.

Let’s Simplify It Further: A Real-Life Example

Imagine you run a company that’s planning to launch a new product. Here’s how COSO ERM might look in action:

- Governance and Culture: Leaders create a space where teams can flag concerns without fear.

- Strategy and Objective-Setting: The product’s launch timeline and goals are aligned with the team’s capacity and market risk.

- Performance: Risks like supplier delays or technical bugs are identified and assigned mitigation plans.

- Review and Revision: After early market testing, the product strategy is revised to better meet demand.

- Information and Reporting: Weekly reports help leadership stay informed on progress and potential risks.

That’s the power of COSO ERM—it brings structure to what can feel like chaos.

20 Principles Behind the Framework

Each of the five parts of COSO ERM is supported by specific principles—20 in total. These cover things like:

- Setting the right tone at the top

- Thinking ahead about possible risks

- Communicating clearly

- Learning from mistakes

These principles make the framework practical and adaptable—whether you’re a Fortune 500 company or a fast-growing startup.

How Is COSO ERM Different From Regular Risk Management?

Traditional risk management tends to focus on compliance and internal controls. COSO ERM takes it a step further by:

- Connecting risk to strategy and goals

- Encouraging collaboration across departments

- Viewing risk as a value driver, not just a threat

It’s more forward-looking and tied directly to business success.

Who Should Use COSO ERM?

Honestly? Almost anyone who runs or works in a business that makes decisions.

But it’s especially valuable for:

- Executives and board members

- Risk managers and compliance teams

- Strategy officers and business analysts

- Project managers and department heads

Whether you’re in finance, healthcare, tech, or manufacturing—COSO ERM fits.

Final Words: Why COSO ERM Matters More Than Ever

Today’s business environment is unpredictable. The companies that succeed aren’t just the ones that avoid risk—they’re the ones that understand it, plan for it, and turn it into opportunity.

The COSO ERM Framework gives you a simple yet powerful way to do that. And the best part? You don’t need to be an expert to start using it. You just need to be ready to think smarter about risk.

Explore Best Online Courses to Learn Risk Management

If you’re new to risk management or looking to deepen your expertise, there’s no better time to start than now. Learning from industry experts can help you build a strong foundation and gain certifications that set you apart in the job market.

At www.smartonlinecourse.com, in collaboration with the Risk Management Association of India (www.rmaindia.org), you can explore a range of self-paced, affordable online courses designed for both beginners and professionals. These courses are tailored to real-world needs, taught by experts, and designed for flexible learning.

👉 Visit www.smartonlinecourse.com to explore more!

📧 Email: [email protected]

Or WhatsApp us at: 8232083010/9883398055