EShakti- A Digitisation of Self Help Group (SHGs)

E-Shakti a Digitisation of SHGs is an initiative of Micro Credit and Innovations Department of NABARD in line with our Hon’ble PM statement, ‘we move with the dream of electronic digital India. Digital India is a Rs 1.13-lakh crore initiative of Government of India to integrate the government departments and the people of India and to ensure effective governance. It is to “transform India into digital empowered society and knowledge economy”. Keeping in view the Government of India’s mission for creating a digital India, NABARD launched a project for digitisation of all Self Help Group (SHG) in the country. The project is being implemented in 100 districts across the country.

Objectives

The aims at digitisation of all the SHG accounts to bring SHG members under the fold of Financial Inclusion thereby helping them access wider range of financial services together with increasing the bankers’ comfort in credit appraisal and linkage by way of Integrating SHG members with the national Financial Inclusion agenda. Improving the quality of interface between SHG members and Banks for efficient and hassle free delivery of banking services by using the available technology; Facilitate convergence of delivery system with SHGs using Aadhaar linked identity.

Need of digitisation

The need of digitisation of records of SHGs has been felt for quite some time due to patchy and delay in maintenance of books of accounts. Transparent and proper maintenance of records of SHGs will facilitate in nurturing and strengthening of SHGs. It will be also helpful for SHGs credit linkage with banks.

It is also felt that digital empowerment will help in bringing SHGs on a common web based e-platform by making book keeping easy for low literacy clients. This will help in promoting national agenda of Financial Inclusion and pave the way of credibility of SHG data which can later be used by Credit Bureaus to reduce the issues related to multiple financing by banks.

Stakeholders of the programme

Rural poor community and members of SHGs, Self Help Promoting Institutions (SHPI), (NGOs), Banks, NABARD, Government development departments and agencies like SLRM, NLRM etc. At a later stage Credit Bureaus may also be on board.

Attributes of the programme

- E-book keeping for the SHGs

- Regular updates of transactional data

- Reports generated in the formats as required by stakeholders like bankers

- Inbuilt automatic grading of SHGs based on NABARD/IBA(for NRLM) norms

- Auto generation of Loan application for the bankers on input of resolution to borrow by SHG

- Mapping of the existing SHGs in the district (bank wise, branch wise)

- Training of volunteers to collect SHG wise/ member wise data

- Data feeding through a customised software in central server

- Maintaining data centre and data recovery centre

- Regular update of the transactional data

- Generating MIS for various users

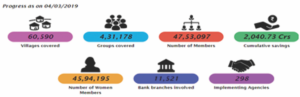

Progress of digitisation of SHGs as on 04-03-2019. Given in below diagram:

Process of Digitisation

Information of all the SHGs and their members are uploaded onto the website. The transactions are updated through ‘apps’ on android Mobile/Tablet. Data authenticity is ensured through SMS alerts to members and sample audits. MIS reports on groups are generated and progress is tracked on a real time basis. Overall, the whole ecosystem was designed to address the complex issue related to patchy financial records of SHGs. and information captured at two levels in following manner.

- Member Level

Name, address, gender, marital status, Physically Challenge status, Aadhaar details, Voter ID card details, mobile number, BPL/APL status, membership of any Joint Liability Group (JLG), house type, availability of toilets, electricity connection and other financial details like saving bank account number, savings, borrowing & repayment, life/ medical insurance, micro pension policy (if any).

2. SHG level

Name, address, date of formation, name of SHPI/NGO, programme under which supported, savings habits, lending policy, bank linkage, details of periodic savings collected and internal lending, utilisation of bank credit availed for members.

Output and MIS-Following detail we can obtain from digitisation package of SHGs

- Member wise details of SHGs on saving, lending, attendance

- SHG and member wise credit history

- Financial statement of SHGs – Balance sheet and Profit and Loss account

- Grading chart of SHGs

- Micro Credit Plan of the SHGs

- Audit report

- Bank linkage details – savings and credit disbursement

- Other periodical MIS on performance of SHGs

Challenges

- Sourcing of information from poor database and records

- Large scale training and capacity building of SHGs, SHPIs and others involved in implementation of the programme

- Capture of field level information from SHGs in a limited time and periodic upload of savings and credit details of SHGs

- Cooperation from banks

- GPRS connectivity

Benefits

- Provided credit to SHGs based on real time performance

- Significantly reduced Saving-Credit linkage gap

- Captured credit history of members

- Promoted transparency through real time SMS alerts in 10 languages to members

- Aided convergence of SHGs with other Government Programmes

- Integrated members with the larger Financial Inclusion Agenda

- List of non-credit linked SHGs

- System generated SHG loan application

- Recovery performance of SHG month wise

- Real time grading of SHGs

Paving way for Credit Linkage of SHGs

- About 31 MIS reports like Meetings, Savings, Credit linkage, Repayment and demand collection balance can be generated sitting in the Bank branch itself.

- Easier processing of loan using E-Shakti system generated prefilled application forms with all the information on members and groups.

- Bank branches to access the portal https://eshakti.nabard.org through Intranet or internet using their branch IFSC and password.

Conclusion

The main USP of this E-Shakti project is ‘one click’ availability of the financial health of self-help groups maintaining SB a/c with Bank/Branches. This portal grades the SHGs based on financial transactions and enables Banks to pick good quality SHGs for extending credit assistance. This portal will be of immense help to banks to take credit decisions on SHGs. Banks are therefore advised to make use of E-Shakti portal for increasing the credit to SHGs

References:

National bank for agriculture and rural developmen

Authored By:

Pravindra Kumar

Pravindra Kumar

Senior Manager – Faculty

Staff Training Centre

Union Bank of India

Kolkata