CBDT unveils tax calculator to help choose between old, new regime

CBDT unveils tax calculator to help choose between old, new regime

After adding a sweetener to the new Income Tax regime, the Central Board of Income Tax (CBDT) has introduced a calculator on its website to assist the assessees in choosing between two regimes. The calculator can be accessed through this link.

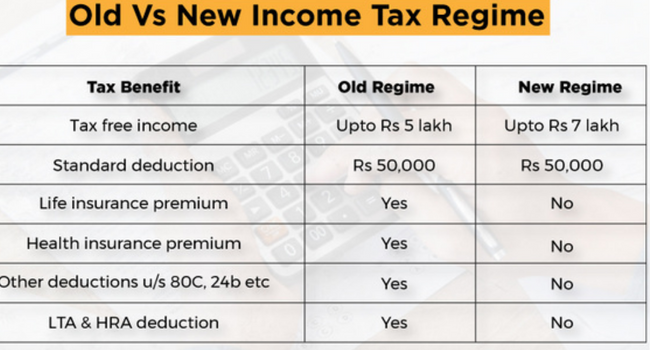

Changes in the new regime are proposed to be applicable from the assessment year 2024-25 (Financial Year 2023-24). These changes will be effective once the Finance Bill 2023 is enacted, which includes raising the rebate to Rs. 7 lakh from Rs. 5 lakh and allowing the standard deduction. As earlier, exemptions under section 80 C of the Income Tax Act and other exemptions, such as interest payment on housing loan and premiums paid towards health insurance, will continue not to be allowed.