DECODING FINANCIAL CRIME OF MONEY LAUNDERING

Abstract: This article is about the definition & concept of financial crime of money laundering. The article explains

the different stages involved in the entire process of money laundering. Impact of money laundering on economic stability, social governance on the jurisdiction prone to money laundering. Criminal money, once assimilated in the formal economy, negatively affects the reputation, and social & financial fabric of these jurisdictions. To prevent criminals from using the financial system, financial institutions need to have a robust ‘Anti Money Laundering (AML)’ Compliance system & procedures.

There are various organizations who monitor the progress and implementation of AML Compliance in different jurisdictions. According to the strength of their AML compliance system and procedures, these jurisdictions are categorised in different risk categories regarding money laundering risk.

Introduction:

Financial crimes involve illegal activities that result in financial gain at the expense of other persons involved in financial transactions. These crimes often encompass deception, manipulation, misuse, or abuse of financial systems. Financial crimes are usually non-violent in nature, but they can have enormous economic impacts & trust deficits in financial system as well as in regulatory institutions. According to the Financial Action Task Force (FATF), some of the major financial crimes are as under:

Financial crimes involve illegal activities that result in financial gain at the expense of other persons involved in financial transactions. These crimes often encompass deception, manipulation, misuse, or abuse of financial systems. Financial crimes are usually non-violent in nature, but they can have enormous economic impacts & trust deficits in financial system as well as in regulatory institutions. According to the Financial Action Task Force (FATF), some of the major financial crimes are as under:

1. Money Laundering

2. Terrorist Financing

3. Organised Crimes

4. Trafficking of humans & narcotics drugs

5. Sexual exploitation of children & women

6. Corruptions & fraud

In this article we shall be decode the financial crime of money laundering. This financial crime is still a cause of concern because of periodic incidents like Panama Papers leaks, Swiss Leaks, failures of financial institutions, and turbulent economies of certain countries.

Definition of Money Laundering: Initially the idea of money laundering was the conversion of ill-gotten money into legitimate money. This conversion was merely considered as a crime of tax evasion only.

In the year 2000, United Nations in its convention against organised crimes, popularly known as “Palermo Convention”, money laundering was defined:

1. the conversion or transfer of property, knowing it is acquired from a criminal offense, for the purpose of concealing or disguising its illicit origin or of assisting any person who participates in the commission of the predicate offence to evade the legal consequences of his or her actions; and

2. the concealment or disguise of the true nature, source, location, disposition, movement, or ownership of rights with respect to, or ownership of the property knowing that such property is derived from a criminal offense; and

3. the acquisition, possession, or use of property, knowing at the time of its receipt that such property was derived from the proceed of a criminal offense or from participation in any one of the forms such as association with or conspiracy to commit or attempt to commit or aiding or abetting or facilitating.

In India, money laundering is defined in the Prevention of Money Laundering Act (PMLA) 2002, as under:

“Whosoever directly or indirectly attempts to indulge or knowingly assists or knowingly is a party or is actually involved in any process or activity connected with the proceeds of crime including its concealment, possession, acquisition or use and projecting or claiming it as untainted property shall be guilty of offence of money-laundering.”

In all the definitions of money laundering given by different institutions or countries, the most important thing to take note of the “knowledge” of the criminal offence through which the dirty money is generated is “essential.”

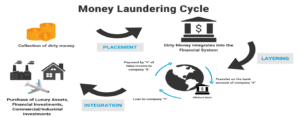

The entire process of money laundering, which includes the complex chain of multiple transactions, is completed in three different stages viz. Placement, Layering, and Integration.

Placement the Stage One: In this stage, the physical cash or other assets derived out of a criminal offence are disposed of. This is executed by introducing them into financial systems. This is done in a manner that “hides” the source of criminal offence and this is the prime motive of criminals in the placement stage. Few examples of placement stage of money laundering are as under:

a. By splitting up large amounts of cash into smaller amounts to bring the transactions within the reporting threshold limits to avoid the enhanced due diligence. This method is known as “Smurfing” or “Structuring,” where illegal money is split into transactions below reporting thresholds set by financial institutions e.g., under $10,000 in the U.S. and Rs 50000/- in India. This helps them in introducing illegal cash into a Bank accounts.

b. Physical movement of cash, known as currency smuggling, in this currency is transported to the jurisdictions which are considered to be a safe haven for financial crimes.

c. By prepaying legitimate loans with dirty money. Using dirty money for purchasing foreign exchange, buying chips or tokens in a casino, gambling for a period, and then cash out.

d. By blending the illegal money with legitimate cash generated by way of a cash intensive business such as in a restaurant, clubs, bars, retail stores, petrol pumps or gas stations etc.

All these methods help criminals to place their money into financial system by disguising the criminal offence behind it. Once dirty money is placed in the system, it is ready to be circulated within the financial network.

Layering the Stage Two: The main objective of the criminals in this stage is to detach it from the criminal offenses which generated the same. This is done by creating complex web of financial transactions, which helps criminals avoid the money trail. Few examples of this stage of money laundering are:

a. Moving funds from one jurisdiction to another or from one financial institution to another via electronic transfers to make a complex web of transactions.

b. High cost & quality goods bought with dirty money, like luxury Yats, Cars, arts, paintings, or other items of value are sold at a discount for clean money.

c. Use of shell companies, the companies which exists only on papers, to hide the ultimate beneficial owners of the assets derived out of dirty money.

d. Converting dirty cash, after layers of transactions, into different monetary instruments like stocks, bonds, insurance products, or derivatives.

Once the dirty money undergoes layering stage it becomes difficult for the regulatory authorities and for financial institutions to find the criminal offence behind this money.

Integration the Stage Three: This is the last stage where criminals reintroduce their dirty money into the economy. This is done in a manner that makes money appear to be from a clean source. The dirty money is now ready to be used as clean money. Criminals start enjoying the money legitimately with minimum suspicion of authorities. Once the money is reintroduced into the financial system, it becomes most difficult to differentiate it from clean money. Few examples of this stage of money laundering are:

a. Criminals invest laundered money in buying different things such as luxury cars or Yats, artwork, restaurants, other retail businesses etc. even at a high cost. Income generated out of these assets make criminals to enjoy their criminal proceeds.

b. Criminals also integrate their criminal proceeds into real estate assets at inflated prices, this makes money flow freely in the formal economy of the country.

Money laundering with its three different stages is depicted as under:

Menace of Money Laundering: As per estimation made by the United Nations Office on Drugs and Crime (UNDOC), an amount equivalent to $800 billion to $2 trillion in US dollars is laundered annually. This menace adversely affects people, society, business & economy, and governance of countries. It has the potential to disrupt economic stability, erode the credibility of financial institutions, and lead to other financial crimes.

A country’s economy is devasted when money launderers take hold of various assets in that country. They sell their assets either with inflated or deflated prices. In both cases, the outcome is loss to people and loss of revenue for the government. This eventually results in the non-implementation of various socio-economic development programs, run by the government, due to a lack of revenue. In this way, a country falls into a trap, and it becomes difficult for it to become a developed country.

The developed and advanced economic centres are also preferred by money launderer for constructing large amounts of transactions by mixing them with clean money. They do it by making relations with officials holding administrative & government authorities. These relations enable criminals to have unfettered access to systems and controls, thus enabling them to manage their criminal activities in a continuous manner.

Association with Other Risks: Primarily the criminality of money laundering has led to the failure of various financial institutions viz. First Internet Bank, European Union Bank, Riggs Bank etc. The economies of our neighbouring countries Pakistan & Sri Lanka have experienced instability and continue to face significant challenges due to the predominance of money laundering crime. Few other risks associated with it are as under:

a. The jurisdictions with less stringent laws for ‘AML Compliance’ lose their reputation. Funds moving through these jurisdictions are subject to enhanced due diligence & more scrutiny, which results in less inflow of funds. Because of this, these jurisdictions become unable to take part in various development programs run by different global development institutions.

b. Any jurisdiction failing either in the implementation of a stringent AML & CFT framework or in the prevention of movement of illegal funds might be subject to comprehensive or targeted sanctions issued by different global agencies. Any failure to comply with these sanctions may result in civil or criminal penalties.

c. The objective of criminals is hiding the source of money not to earn profit from their dirty money. This gives them an economic advantage over regular industry people. People from genuine industry or businesses suffer because of presence of criminal. While dirty money keeps flowing, but supply of clean money becomes restricted or limited.

Efforts to Counter Money Laundering: Global efforts against the menace of money laundering started in 1998 with the formation of FATF by G7 countries. FATF has made 40 recommendations for financial institution’s AML-CFT Compliance framework. These recommendations need to be adopted & implemented in an effective manner by the financial institutions. This implementation is regularly evaluated by the FATF and its regional style bodies FSRBs to ascertain the efforts done by the jurisdictions to combat money laundering. On the basis of these evaluations, jurisdictions are placed on “Black or Gray” list if these recommendations are not implemented appropriately.

FATF has also introduced the “Risk Based Approach,” meaning jurisdictions & financial institutions need to assess and understand the money laundering risk to which they are exposed. Suitable mitigation measures, in accordance with the risk anticipated, need to be ensured by them in order to mitigate & manage the money laundering risk.

Another important effort was made by the Basel Committee on Banking Supervision (BCBS) through their “Statement of Principles for Prevention of Criminal Use of the Banking System for the Purpose of Money Laundering.” These supervisory recommendations in brief are as under:

a. Financial institutions need to identify persons through the “Customer Due Diligence (CDD)” process before onboarding them as customer. The CDD process requires to establish the identity of natural persons, who are the beneficial owners. The Persons with anticipated ‘High AML Risk’ must be subject to ‘Enhanced Due Diligence.’

b. Financial Institutions must follow rules and regulations about AML CFT compliance, issued by the local regulators as well as other supervisory institutions.

c. Financial institutions must be in conformity with high ethical standards, have a corporate governance policy, and should do full cooperation with agencies as per local laws.

d. Financial institutions should arrange for regular staff training for AML, KYC, and CFT. They should have an independent audit function along with strong compliance monitoring program.

3. Other important global organisation for strengthening global “AML CFT Compliance” is “The Wolfsberg Principles.” These principles represent a set of guidelines and best practices, covering various aspects of financial crime risk management, including customer due diligence, enhanced due diligence for high-risk clients, correspondent banking relationships, and the detection and reporting of suspicious activities.

4. In India, the Prevention of Money Laundering Act (PMLA) 2002 is implemented to combat money laundering and related financial crimes. The law was enacted to align with global AML-CFT Standards. This law, along with the “Prevention of Corruption Act 1988” and “Foreign Exchange Management Act 1991, plays a robust role in safeguarding the Indian financial system from criminals.

Conclusion: It is extremely critical for financial institutions to prevent criminals from misusing the financial system. Financial institutions are like the backbone of an economy. Therefore, financial institutions must understand the risk of money laundering crime, which they are exposed by virtue of their business lines. They should be able to implement stringent & effective AML & CFT measures. This would help them from reputational damages, financial losses, and also from being a part of the systemic financial crisis.

About Rahul Sharma

I joined the State Bank of India in April 2002 as a ‘Probationary Officer’. I am having Banking experience of more than twenty years. During this period, I have worked in various Branches as a ‘Field Officer & Branch Manager’. I have also worked in senior positions in Credit Monitoring and NPA Management.

I have also worked as Manager Compliance & MLRO at Bank’s SBI DIFC Dubai Branch, which is a wholesale Banking Branch in Dubai.

My educational qualification is M.Sc. (Maths) and both parts of CAIIB. Besides this I have done the following Diploma & Certifications:

- Certified Anti Money Laundering Specialist, Miami USA

- Certified Financial Planner from FPSB, USA

- Post Graduate Diploma in Financial Advising from IIBF

- Diploma in Treasury, Investment & Risk Management from IIBF

- Diploma in International Banking & Finance from IIBF

- Certificate course in Risk in Financial Services from CISI London

- Certificate in Commercial Credit (CICC) by MOODY’s

- Certificates in Digital Banking, IT Security, AML & KYC, Customer Service & Banking Codes and Standards, and Foreign Exchange Facilities for Individuals from IIBF.

Currently, I am working as AGM & Faculty at State Bank Foundation Institute, Chetana- Indore, M.P. My contact details are mentioned below:

Rahul Sharma, AGM (Faculty)

State Bank Foundation Institute-CHETNA, Indore, (M.P.)

Mob: 7471126853

Email: [email protected]