Economic slow down – will it pick up, how and when

India’s economy grew slower than expected to a 20-quarter low in the January-March period, dragging overall growth to a five-year low in FY19, Following on from this, the central bank is widely expected to cut interest rates further to bolster the flagging economy.

let us have a look into the reasons of slow growth and measures to arrest further slide.

What has happened –

India’s economy slipped by 5.8 percent in the fourth quarter ending March 2019. GDP growth in the previous quarter was recorded at 6.6 percent. In the fourth quarter of the last fiscal year (2017-18) GDP growth was reported at 8.1 percent. The numbers presented by the CSO underlines a cooling economy.

What is concerning? For the full fiscal 2018-19, the country recorded GDP growth of 6.8 per cent – a low in five fiscal years. Last fiscal year, India’s GDP growth rate was reported at 7.2 per cent. To arrest this slowdown will be first challenge to new government.

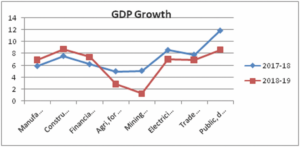

Sector wise GDP growth trend is as under-

As per the data, the economic activities which registered growth of over 7 per cent on a YoY basis in 2018-19 were ‘public administration, defence and other services’, ‘construction’, ‘financial, real estate and professional services’, ‘electricity, gas, water supply and other utility services’.

As per the data, the economic activities which registered growth of over 7 per cent on a YoY basis in 2018-19 were ‘public administration, defence and other services’, ‘construction’, ‘financial, real estate and professional services’, ‘electricity, gas, water supply and other utility services’.

“The growth in the ‘agriculture, forestry and fishing’, ‘mining and quarrying’, ‘manufacturing’ and ‘trade, hotels, transport, communication and services related to broadcasting’ is estimated to be 2.9 per cent, 1.3 per cent, 6.9 per cent and 6.9 per cent, respectively,” the CSO said.

The growth in Manufacturing, Construction and financial real estate sector has been more compared to previous year. Whereas in other sectors growth is declined.

The scenario of agriculture sector too does not look very bright. Elaborating further on the CSO data, chief economist ICICI securities Prasanna says “weak rural activity indicators have also been impeding growth recovery as captured in low rural wages, slowdown in credit to medium scale industries and nascent recovery in two-wheeler and commercial vehicle sales.

Acreage for the rabi crop was lower than last year, which has impinged on the agricultural performance.” He expects consumption impulses to remain muted in the upcoming print and recovery in the same will “depend on the monsoons and the efficacy of the income schemes for the rural population.” Monsoons have remained more or less erratic in the past five years and water scarcity has been amply reported from states of Maharashtra, Tamil Nadu and other parts of the country. The factor of a developing El-Nino could potentially leave farmers with a hole in their incomes.

Private final consumption expenditure in the year rose 8.1% and capital investment as measured by gross fixed capital formation expanded 10% from 9.3% in the previous fiscal.

Investment in terms of GDP has declined from 32.2% to 29.8%

Export in terms of GDP has also declined from 11% to 9% for the year 2018-19.

India’s per-capita income increased 10% to Rs 10,534 per month in 2018-19 from Rs 9,580 in FY19. The per-capita income is an indicator of the prosperity of a country.

India’s industrial production fell 0.1 percent from a year earlier in March 2019, the first month of contraction since June 2013. Manufacturing production shrank 0.4 percent, the same pace as in the previous month, while mining output rose at a softer pace (0.8 percent vs 2.2 percent). On the other hand, electricity output growth accelerated to 2.2 percent from 1.3 percent. Industrial production for 2018/19 grew at 3.6 percent, slower than 4.4 percent in the previous fiscal year.

A Mint analysis showed that slower sales have dragged profits of companies that reported earnings for the quarter ended March 31 to the slowest in at least 13 quarters.

Aggregate net profit growth of 334 BSE-listed companies that reported March quarter earnings (till May 7) fell 1.5 percent from a year earlier after adjusting for one-time gains or losses, according to data provider Capitaline.

Small Finance Banks, Corporate Banks, Cement stood out in terms of performers during Q4. Small and Midcap IT, select real estate, sugar, Fertilisers, paper, and Hotels also did well.

Auto, auto ancillaries, carbon and steel companies underperformed. Metal companies reported their first contraction in profits in the last three years.

Lower sales have dragged profits down as operating leverage has also faded. Slow global growth, liquidity squeeze. Government spending slowdown and rural earning slowdown are all impacting revenue and profit growth in Q4.

Sectors affected include auto, auto ancillaries, agrochem, and NBFC. In Pharma, margin expansion was seen, while FMCG companies cut costs including ad spend. Interest depreciation and taxes grew at a slower pace.

On final expenditure front during 2018-19 growth has been seen in PCFE and GFCF while growth has declined in export, GFCE, import and CIS. Valuables have witnessed negative growth.

Factors responsible

- “Slow down in the fourth quarter GDP was due to temporary factors like stress in NBFC sector affecting consumption finance. NBFCs have been under liquidity pressure after the shock default by Infrastructure Leasing & Financial Services (IL&FS) in September last year.

- Key segments such as agriculture, industry indicate slowdown. The industrial slowdown has its origin in real estate and infrastructure crisis.

- industrial sector stress is on account of high costs of borrowing, increase in commodity prices and a slowdown in global trade.

- “Weak rural activity indicators have also been impeding growth recovery as captured in low rural wages, slowdown in credit to medium scale industries and nascent recovery

- The weakening jobs scenario with urban unemployment rate at 7.8 per cent and rural at 5.3 per cent are significant causes of concern.

- Shadow banks were responsible for nearly a third of incremental loans in the system over the past three years. But, since September last year, when a funding crunch forced them to focus on survival, credit growth in the system has slowed.

- Other factors may also be contributing to the current slowdown is lack of demand. The raises for government workers mandated by the last pay commission have started to dwindle in their impact,

- But, the consumption cutbacks on durables and consumer staples in recent months suggest that the Indian middle class is also not playing ball in the overall somber mood. Companies are having a difficult time pushing volumes and raising prices.

- Despite exports and imports growing at the same rate of 9 per cent, India’s trade deficit reached a record high of $176 billion in 2018-19.

- According to data released by the commerce and industry ministry on Monday, exports stood at $32.55 billion in March, taking the total tally in 2018-19 to $331 billion. While it is the first time that outbound trade has remained above $300 billion for two consecutive years, exports couldn’t cross the government’s internal target of $350 billion. In the 2017-18 financial year, exports stood at $303.52 billion.

- On the other hand, a continuous shoot up in imports, which grew at double digit levels for 6 of the last 12 months, took cumulative imports to a soaring high of $507.44 billion. This was nearly $42 billion more than India’s total bill in the preceding year.

Silver lining –

However, the fiscal deficit at 3.4 per cent of GDP, was largely in line with expectations and can be a seen as a silver lining.

On the brighter side, however, India’s annual GDP growth rate stands at 6.8% while China reported 6.6%. Although India has maintained the title of fastest growing GDP rate, there have been cases when it lost that title temporarily.

After a gap of five years, exports in 2018-19 saw their footprint on the country’s Gross Domestic Product (GDP) rise, trade receipts reached record a high of $331 billion in the last financial year,

Private consumption has increased slightly from 59% to 59.4% of GDP in the year 2018-19. Similarly government expenditure has also increased from 9.3% to 11.2% for the corresponding period.

Future outlook –

First quarter of current fiscal (2019-20) would also witness relatively slow growth and from second quarter onward it will pick up,” Garg told reporters.

Considering indicative data points and scenario, experts expect gradual recovery from H2FY20, led by decent monsoon, pickup in consumptions coupled with impetus from monetary policy and measures in upcoming full union budget.

Finance Secretary Subhash Chandra Garg said the slowdown could continue in the first quarter of the current fiscal but the situation would improve in the second quarter (July-September). “We see growth and consumption improving in the July-September (second quarter) period. Problems faced by NBFCs affected consumption in the finance sector, expect credit growth in the NBFC sector to pick up . Expect pick-up in capital and private investment”, he added.

Management commentary suggested that demand is likely to pick up after the elections, especially for materials such as cement, as more housing and construction projects would take off.

stability in the new Govt and reduction in global trade tensions would help matters in reviving growth from hereon.

“In India, growth is projected to pick up to 7.3% in 2019 (2019-20) and 7.5% in 2020, supported by the continued recovery of investment and robust consumption amid a more expansionary stance of monetary policy and some expected impetus from fiscal policy,” IMF said in its World Economic Outlook report released on Tuesday.

IMF also cut its global growth forecast for 2019 by 20 basis points to 3.3%—the lowest since the financial crisis in 2008—blaming trade tensions between the US and China, loss of momentum in Europe and uncertainty surrounding Brexit.

Both ADB and RBI last week cut their 2019-20 growth projection for India to 7.2% from 7.4% earlier, blaming rising risks to global economic growth as well as weakening domestic investment activity.

Steps taken

IMF commended the government for taking steps to strengthen financial sector balance sheets through accelerated resolution of non-performing assets (NPAs) under a simplified bankruptcy framework.

May 19 the Reserve Bank of India (RBI) has announced another repo rate cut by 25 basis points (bps). This is the third time in a row that the central bank has cut key rates this calendar year. Borrowers can hope for more rate cuts in the future as monetary policy stance has been changed from neutral to accommodative.

What should be done-

IMF said in its World Economic Outlook. “In the near term, continued fiscal consolidation is needed to bring down India’s elevated public debt. This should be supported by strengthening goods and services tax compliance and further reducing subsidies,” “Efforts should also be enhanced on land reform to facilitate and expedite infrastructure development,” the report stated.

The government has a very limited fiscal space given the budgeted fiscal deficit at 3.4% of GDP. However, current economic conditions call for some stimulus. It will be difficult for the government to adhere to fiscal consolidation path and give stimulus. Any consumption stimulus should not be given, it should give investment stimulus.

On a war footing, they will have to address the issues in basic infrastructure sectors such as power, roads and railways.

Relaxation in liquidity tightness and resumption of Govt spend could provide relief to a large part of the corporate sector and move growth levers in H2FY20.

Some experts feel that More than monetary and fiscal stimulus, what is important at this stage is to undertake confidence boosting measures for credit intermediaries and improve the availability of funds for the stuck projects in infrastructure, construction and manufacturing.

It is expected that the government would undertake rationalisation of GST rates and reviving corporate capex through offering tax breaks could help overcome the current slowing economic activity.

the central bank’s Monetary Policy Committee could certainly help matters by cutting rates faster, especially since the RBI’s own inflation forecasts for the next 12 months are lower than its 4 per cent target. Lower rates can help bring down bond yields and provide some stability to the non-banking side of the financial system.

A further reduction in rates is expected to lift sagging consumer demand. Passenger vehicle sales grew at their slowest in five years, at 2.7% in FY19. and a rate cut, while helpful, will have to be combined with a policy intervention to revive the real estate and infrastructure sectors.

Authored By:

B P Sharma

B P Sharma

Chief Manager (Faculty)

Union Bank of India

Staff Training Centre, Bhopal