Equity fund inflows slow from December high, SIPs hit new record

Most equity scheme categories got inflows, with flexicap funds getting the highest flows of Rs. 2,527 crore followed by sectoral funds at Rs. 2,073 crore and large-cap funds at Rs. 1,890 crore.

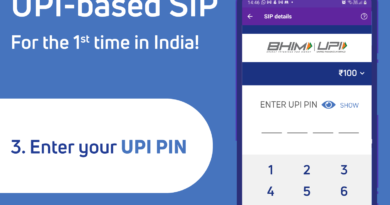

Individual investors continued to pour money into equity mutual funds in January for the eleventh straight month, but flows were lower compared to December as sharp swings in the stock market led to heightened caution. Equity schemes garnered 14,888 crore in January as against 25,077 crore in December. Collections through systematic investment plans (SIPs) increased to another record high of 11,517 crore as against 11,306 crore in the previous month.

Debt mutual funds too saw inflows of 5,088 crore, taking the industry’s total assets under management (AUM) to an all-time high of 38.89 lakh crore, compared to the previous month’s 37.92 lakh crore.

Fund officials and analysts said investors were more cautious in January. In December, the record flows of 25,077 crore were also on account of large collections by three new fund offers.

“Concerns over ‘new’ variants across Agencies the globe, relatively high valuations and rising inflation have likely led to a reduction in the magnitude of flows over the past month,” says Kavitha Krishnan, senior analyst – manager research, Morningstar India.

The resilience in flows into equity mutual funds was despite selling by foreign institutions, who dumped stocks to the tune of 35,975 crore in January for the fourth straight month.