Growth worries keep RBI on long rate pause

The Reserve Bank of India (RBI) held its key lending rates steady at record low levels for the 10th straight meeting to support a durable recovery of the economy from the COVID-19 pandemic.

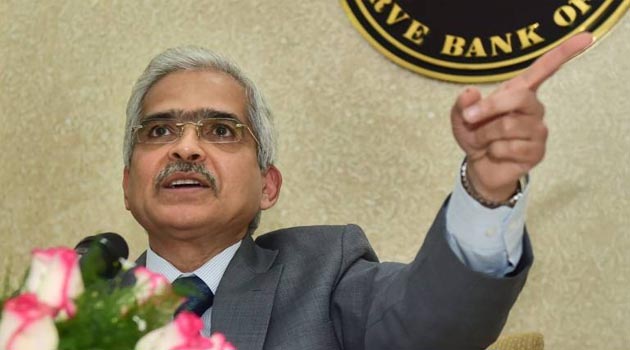

RBI Governor Shaktikanta Das said the Monetary Policy Committee (MPC) decided to hold the lending rate, or the repo rate, steady at 4 per cent, and the reverse repo, or the rate at which it absorbs excess cash from lenders, unchanged at 3.35 per cent.

The six-member MPC, which has been on pause since August 2020, voted unanimously to maintain the status quo on the repo rate and by a majority of 5-1 to retain the accommodative policy stance as long as necessary, he said.

“Monetary policy actions will be calibrated and well telegraphed,” he said, indicating that there will not be any surprises.

“Overall, taking into consideration the outlook for inflation and growth, in particular the comfort provided by improving inflation outlook, the uncertainties related to Omicron and global spillovers, the MPC was of the view that continued policy support is warranted for a durable and broad-based recovery,” he noted.

While a status quo on repo rate was expected, some economists had expected a hike in the reverse repo to re-align it with short-term money market rates.

MPC continuing with the accommodative policy stance was one of the prime reasons Das cited for not hiking the reverse repo rate.

The decision comes days after Finance Minister Nirmala Sitharaman proposed to up spending to support the economy’s world-beating recovery.

“The government’s thrust on capital expenditure and exports are expected to enhance productive capacity and strengthen aggregate demand. This would also crowd in private investment,” Das said.

Other decisions include curtailment of the hours when reverse repo and MSF windows can be availed — a return to pre-pandemic methods of managing liquidity.