How to Sell Demat Shares without a Trading Account?

Whether you are a beginner in the share market or a veteran with years of experience, you might be aware that the stock market mandates two prerequisites – a demat account and a trading account. The former is essential to store the shares, while a trading account is necessary to buy and sell at Indian stock exchanges.

Most online stock brokers offer a combination of demat and trading accounts to users signing up for their platform.

But what happens if you already have shares in your demat account without owning a trading account? Is it possible to sell those shares? Read on to understand the fundamentals of a demat account and the methods to sell your existing shares without creating a trading account.

How Does a Demat Account Work?

A dematerialised (demat) account can be compared to a bank locker, except it provides a secure space to hold your shares. The name originates from the word “dematerialisation,” which translates to the conversion of physical securities into an electronic format.

It is vital to know how a demat account works to better understand its limitations.

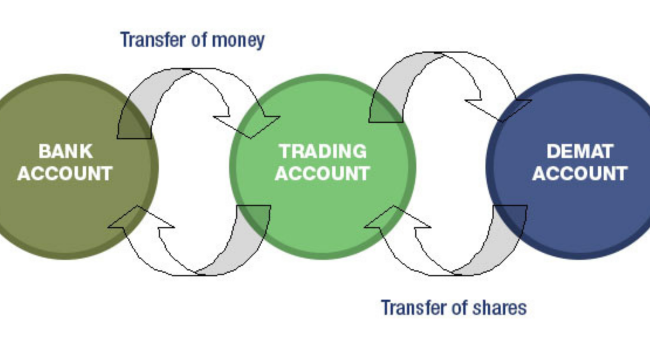

A demat account offers an electronic medium to hold digital copies of share certificates. Using a demat account, it is easier for you to buy and sell shares since these accounts are usually connected with a trading account. The process is highly efficient and consumes less time, enabling faster transactions.

Unfortunately, demat accounts are strictly limited to the storage of funds. Without a trading account, you cannot buy or sell new shares directly from your storage account. For example, if you are willing to trade for intraday and already have the researched list of best shares for intraday trading, you will still not able to do the buy and sell transaction if you don’t have a trading account. Hence it’s highly recommended to open your demat and trading accounts simultaneously. However, there are specific cases when you may receive shares in your demat account without creating a trading account.

When do you Require a Demat Account But not a Trading Account?

You might be curious about demat accounts being independent of trading accounts. After all, it has been constantly reiterated that trades cannot execute without a verified trading account.

However, it is vital to remember that all shares deposited in your demat account might not be the result of a stock market trade. Here are some of the unique circumstances.

Gift Stocks

The feature to transfer over stocks exists in almost all major stock brokers online. The only requirement for you to receive gift stocks is the creation and verification of a demat account. If you plan to hold these shares long-term, you do not need to create a trading account immediately.

Physical Shares

The advent of demat accounts has curbed the practice of physical shares. However, buying physical shares is a viable alternative to creating a trading account. You can trade on the respective stock exchanges through a physical broker and acquire share certificates of your purchases.

The best part? It’s easy to convert these share certificates into a dematerialised form using the Demat Requisition Form (DRF) available with your depository participant.

Selling Demat Shares Without a Trading Account: Is it Possible?

In most cases, brokerage houses will notify you that it is impossible to sell demat shares without a trading account. This part is only true if you deal with the secondary market.

An alternative is the direct stock plans offered by several companies. It is a system where you deal directly with the organisation, enabling you to buy or sell their stocks without middlemen. These companies levy a minimal fee on each transaction and may define a minimum investment amount.

In direct stock plans, the organisation will offer or accept stocks during specific times, disregarding the usual market hours. The window may either be open weekly or after every few months. The buying and selling price remains the same as that of the average market value of the stock.

Additionally, you gain the flexibility to transfer your shares to your demat account or collaborate with a broker to sell them in line with the market activity to acquire maximum profits.

Moreover, some companies offer a dividend reinvestment plan where you can use periodic cash dividends to increase your shares in the company’s stock. In these cases, you might have to contact the company directly and sign an agreement detailing the conditions of the deal.

What Should You Choose?

If you are in a dilemma about demat and trading account creation or looking to deal directly with the company through direct stock plans, assess the strengths and weaknesses of each method.

When you register with a reputed broker like Choice India, you can create a demat and trading account quickly and start buying and selling stocks in the market. Alternatively, you can invest in a collection of mutual funds to increase long-term wealth if you do not wish to create a trading account.

While mutual funds are susceptible to risks, these funds have experienced managers who understand the nuances of the financial market. You can browse through index or commodity funds to decide the best investment. The only downside is that you have to maintain a predefined risk appetite.

On the other hand, direct stock plans are valuable for individuals without a trading account, especially NRIs. However, they may severely limit your options in the market, and discussions with each company may take a considerable amount of your time.

Hence, make a decision based on your level of comfort. All these instruments are equally effective in helping you build long-term wealth at a higher rate than traditional avenues like fixed deposits.

Summing Up

The stock market has evolved from being an enigma to a more demystified space with tons of research material and how-to tutorials available on the internet. Several reputed stockbrokers like Choice India provide a rich resource repository to further your understanding of the market and promote more informed investments.

It is a good idea to undertake a thorough study of the stock market before making your first investment. Whether you plan to “hold” stocks or choose short selling, gauge the performance of the market and assess each company’s stock to ascertain their position, cash flow and other important factors.

So, create a demat account with Choice India now and gain an introduction to the massive world of alternate instruments!