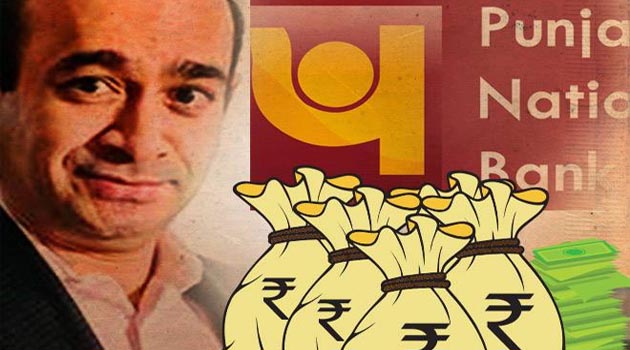

Private bank officials summoned in PNB fraud case

Top executives of private sector bank ICICI Bank Ltd and Axis Bank Ltd appeared before the Serious Fraud Investigation Office (SFIO) as investigative agencies expanded their probe into the alleged bank fraud by companies linked to Nirav Modi and his uncle Mehul Choksi.

SFIO and Enforcement Directorate (ED) are investigating 31 private and PSU banks that in a consortium gave working capital loans worth Rs.5,280 crore to Choksi-controlled Gitanjali Gems Ltd starting 2009.

This is in addition to the Rs.12,636 crore Punjab National Bank (PNB) fraud investigation, which involved fake letters of undertaking.

ICICI Bank Ltd has an exposure of Rs.750 crore to the Gitanjali group of companies and Rs.500 crore to Gitanjali Gems. PNB has an exposure of Rs.900-1,000 crore, the highest among the lenders.

SFIO, the investigative agency under the ministry of corporate affairs (MCA), summoned Chanda Kochhar, managing director and chief executive officer of ICICI Bank, and Axis Bank CEO Shikha Sharma, to seek information on the working capital loan given by the consortium of bankers to Gitanjali Gems, an MCA official said.