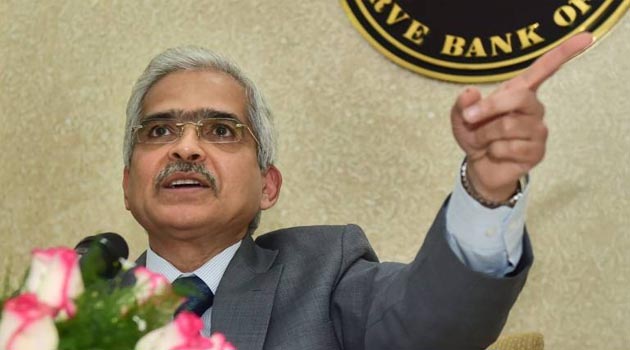

RBI Governor: AI raises cyber security risks

RBI governor Shaktikanta Das said that with the advent of AI, cyber security challenges can rise manifold, and called upon financial institutions to dedicate substantial efforts to protect customer information.

Regulated entities serve as repositories of data on financial transactions, customer interactions, and operational activities, the governor said in his inaugural address at the Annual Conference of RBI Ombudsman here.

Das noted that with the rise in fraudulent transactions, it is critical to strengthen monitoring systems and use technology to detect potential frauds before they materialise. “Maintaining a focus on root cause analysis of consumer grievances can result in preventing such complaints from coming up repeatedly,” he said.

Cyber security challenges can expose consumers to identity theft, fraud, and unauthorised access to personal information, which can affect consumer trust.

“Financial institutions must dedicate substantial efforts to protect customer information and ensure that vulnerabilities exposing customers to risk are promptly identified and addressed,” the governor said. He further added that the litmus test of the working of any institution or entity is the efficacy of its grievance redressal mechanism.