RBI Governor, PM signal reforms in trouble-prone urban co-operative banks

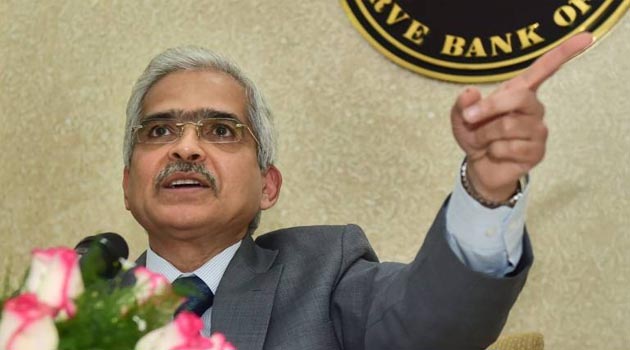

Reserve Bank of India (RBI) Governor Shaktikanta Das indicated that the banking regulator will ring in sweeping regulatory changes to reform urban co-operative banks that have been plagued by a spate of failures, and warned people against parking their savings in banks offering high returns.

While terming the government’s decision to raise the insured limit for bank deposits to Rs. 5 lakh from Rs. 1 lakh with a 90-day time limit to pay out such deposits as ‘landmark’ developments, Mr. Das stressed that the payment of Deposit Insurance should be seen as a ‘measure of last resort’.

“I would like to mention in all this is that the depositors themselves must also be very discerning. It is very important to keep in mind that higher returns are usually associated with higher risks. Just because a bank is offering higher interest, the depositors should be very careful in putting their money in chasing such high returns,” the RBI Governor noted.

“I am not generalising. There are institutions that are offering higher interest rates which are viable, but depositors should always be very careful,” he reiterated at an event to mark the payment of nearly Rs. 1,300 crore to over 1 lakh depositors whose funds were stuck in distressed banks for years.

Prime Minister Narendra Modi, who personally handed over deposit insurance cheques to a few bank customers whose savings with distressed banks had been out of reach for years, said that an additional three lakh depositors would get their hard-earned savings, stuck in other banks, soon.

“When the RBI will oversee co-operative banks’ functioning, this will also raise depositors’ confidence further. We have created a new Co-operatives Ministry (referring to the Co-operation Ministry). The idea is to strengthen the co-operative system and will empower co-operative banks further,” Mr Modi said, noting that these problems afflicted co-operative banks more.

Mr. Das said the central bank keeps depositors’ interests on top while dealing with policy challenges and will continue to ensure that the entire banking system remains robust.

“Just to give an example, we have come out with new governance guidelines for commercial banks and we have constituted a committee for bringing about reforms in the urban co-operative sector. That report has been received and we will be taking action based on it,” he said,