RBL Bank depositors protected, unanswered questions remain: AIBEA

Depositors of the RBL Bank Ltd need not worry about the safety of their money as Section 45 of Banking Regulation Act will protect their interests, said a top leader of All India Bank Employees’ Association (AIBEA).

He also said the branch expansion by RBL Bank within a short span of time — from 92 branches in 2010 to 196 in 2015 and 462 in 2021 — resulted in increased operational expenses, deposits as well as loans and finally the non-performing assets (NPA).

Allaying fears of RBL Bank depositors on the safety of their money C.H. Venkatachalam, General Secretary, AIBEA told IANS: “Section 45 of the Banking Regulation Act gives the depositors the necessary protection.”

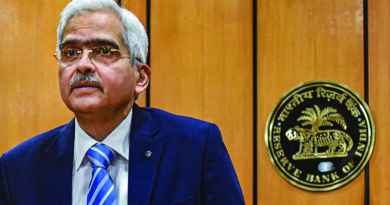

As per Section 45 of the Banking Regulation Act, the Reserve Bank of India (RBI) has the power to apply to the Central Government for suspension of business by a banking company and to prepare a scheme of reconstitution of amalgamation.

It may be recalled, sometime back, Tamil Nadu based Lakshmi Vilas Bank (LVB) was amalgamated with DBS Bank when the former’s financial position went bad.

While the LVB shareholders did not get anything, the funds of the depositors were safe.

“The RBI may impose a moratorium and some other conditions on withdrawal of deposits when it amalgamates a weak bank with another. But the depositors will not lose out,” Venkatachalam said.

The RBI on its part said the bank’s financial condition is stable.